SEC CORNER

SEC ADOPTS FINAL CLAWBACK RULES

The U.S. Securities and Exchange Commission (“SEC”) recently adopted final rules implementing Section 954 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, which added Section 10D of the Securities Exchange Act of 1934 that will require listed companies to disclose and implement policies to “claw back” incentive compensation paid as a result of erroneously reported financial information that is subject to a required accounting restatement. The rule requires exchanges to establish listing standards that will require companies to develop written policies for the recovery of incentive-based compensation received by current or former executive officers. The requirement to claw back applies to incentive-based executive compensation awarded based on financial information that becomes subject to an accounting restatement during the next three fiscal years. In short, companies must recover (on a pre-tax basis) the amount of incentive-based compensation received that was in excess of the amount that the current or former executive officer would have received based on the restated amount, subject to certain narrow exceptions.

The SEC’s release also addresses indemnification and insurance for a claw back, acknowledging that an executive officer may be able to purchase third-party insurance to fund a recovery obligation. “After considering the views of commenters, we are adopting as proposed rules to prohibit issuers from insuring or indemnifying any executive officer or former executive officer against the loss of erroneously awarded compensation.”

SEC ANNOUNCES 2022 ENFORCEMENT RESULTS

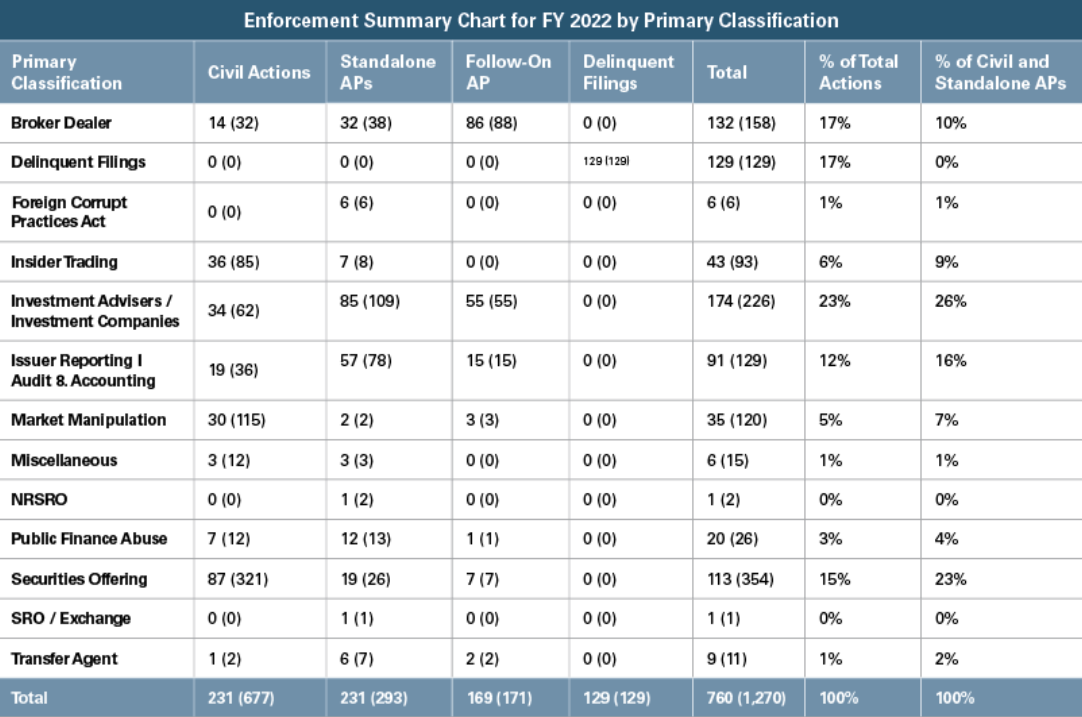

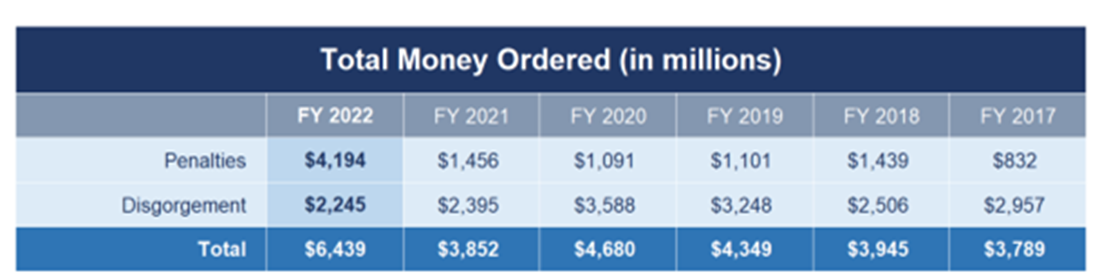

The U.S. Securities and Exchange Commission (“SEC”) has released its enforcement results for fiscal year 2022. The SEC filed 760 total enforcement actions, a 9% increase over the prior year. The enforcement actions included 462 new, or "stand alone," enforcement actions, a 6.5% increase over fiscal year 2021; 129 actions against issuers who were allegedly delinquent in making required filings with the SEC; and 169 "follow-on" administrative proceedings seeking to bar or suspend individuals from certain functions in the securities markets based on criminal convictions, civil injunctions, or other orders. The SEC’s stand-alone enforcement actions in fiscal year 2022 ran the gamut of conduct, from "first-of-their-kind" actions to cases charging traditional securities law violations. The SEC’s Enforcement Summary Chart below provides some details on specific classification of enforcement efforts:

Source: Skadden, SEC Enforcement Division Announces FY22 Results: Increased Enforcement, Record-Breaking Penalties and Focus on Deterrence

Fiscal year 2022 was also the SEC’s second highest year ever in whistleblower awards, both in the number of individuals awarded and the total dollar amount. Fiscal year 2022 comes in second to year 2021, which was the highest year in awards and number of individuals since the program’s inception. With record fiscal years in 2021 and 2022, the SEC is doubling down on its commitment to the program, protecting investors and awarding whistleblowers who provide illegal information in a timely matter.

Finally, this year the SEC brought enforcement actions that address misconduct across a wide variety of violations and violators in the securities markets. These actions included financial fraud and issuer disclosure, gatekeepers, crypto asset securities, cybersecurity and compliance, environmental, social and governance (ESG), private funds, regulated entities and associated individuals, market abuses, public finance abuse, foreign corrupt practices act, and more.

November 2022 Noteworthy Settlements and Judgments

| Amount | Director/Officer | Role | Company |

| $ 100,000.00 | Robert V.A Harra, Jr. | COO | Wilmington Trust |

| $ 50,000.00 | Ruben James Rojas | Chief Business Officer | Montebello Unified School District |