IN THE PUBLIC EYE

The "In The Public Eye" newsletter is dedicated to exploring risk management topics and challenges faced by today's Public Sector leaders.

The January issue of In The Public Eye has arrived! If you have any questions about the articles in this issue or have any other insurance-related questions, please contact us.

2025 Outlook: Commercial Insurance Trends for Public Entities

Optimism in the Commercial Property Insurance Market

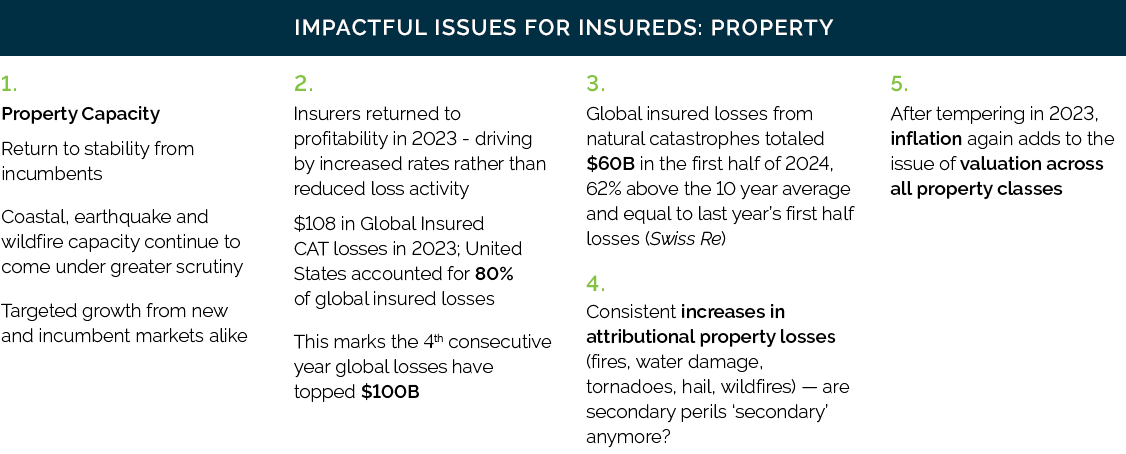

The commercial property insurance marketplace has shown marked improvement, signaling a welcome relief for policyholders after years of turbulence. Increased capacity and stable pricing are driving optimism, making it an opportune time for public entities to reassess their insurance strategies and leverage market conditions to their advantage.

The past few years have been defined by challenges in the commercial property insurance sector, including natural catastrophes, inflationary pressures and tightened underwriting. In 2024, premium growth rates for commercial property insurance moderated to mid-single-digit percentages, a decline from the high teens observed in 2022 and 2023. This shift demonstrates the robustness of reinsurance markets.

2025 ushers in greater stability, with carriers projecting an outlook even more promising than that of 2024. Insurers have been bolstering their balance sheets and refining their risk assessment processes, which has resulted in greater capacity to write new business and renew existing policies.

This increased capacity has led to more competition among carriers, particularly for well-managed risks with robust loss prevention measures. As insurers become more selective in underwriting, entities with a strong risk management track record are reaping the benefits, including access to broader coverage options and improved pricing. While certain exposures, such as properties in catastrophe-prone regions, may still face scrutiny, the overall pricing environment is far less volatile.

Opportunities for Risk Managers

- Reassess Coverage Needs: Evaluate whether your current coverage adequately addresses your organization’s risk profile. Expanded capacity may provide opportunities to secure higher limits or add coverage enhancements.

- Leverage Competition: Increased capacity means more carriers are willing to compete for your business. Work with your broker to market your account to multiple insurers to secure the best possible terms.

- Highlight Risk Mitigation Efforts: Demonstrate your organization’s commitment to loss prevention by sharing details of your risk management programs, such as appraisals, fire protection systems, building maintenance plans and disaster recovery protocols.

- Plan for the Long-Term: Take advantage of stable pricing to implement multi-year insurance agreements, locking in favorable terms and reducing future volatility.

Casualty Capacity Concerns for 2025

Casualty insurance markets are facing a contraction in capacity, with several carriers reducing their exposure or exiting the space entirely. The rising frequency and severity of claims, fueled by inflation and expanding liability theories, have made public entity risks less attractive.

This reduction in capacity is driving up rates, increasing retentions and limiting coverage terms for critical casualty lines, including general liability and excess liability. Public entities should work closely with their broker to explore alternative risk transfer solutions, such as risk pools.

Cyber Liability and Artificial Intelligence

Cyber liability coverage remains a top concern as public entities face increasing threats of data breaches, ransomware and system disruptions. The rapid adoption of artificial intelligence (AI) tools further complicates the risk landscape. While AI can enhance operations, it introduces vulnerabilities such as biased decision-making algorithms, privacy concerns and potential regulatory violations.

Insurers are tightening underwriting standards, scrutinizing cybersecurity protocols and requiring detailed AI risk management plans. Public entities should ensure they have robust cybersecurity measures, including regular vulnerability assessments, incident response plans and AI governance frameworks. Training employees to recognize cyber threats and adhering to regulatory compliance standards are also critical to maintaining insurability and minimizing cyber risk exposure.

Litigation Financing and Its Impact on Claims

Litigation financing, where third parties fund lawsuits in exchange for a share of the settlement, is increasingly influencing claim outcomes. This trend has led to prolonged litigation, higher defense costs and larger settlements or verdicts, particularly in cases involving public entities.

The growing presence of litigation financing underscores the importance for public entities to be aware of its potential impact on legal proceedings. By understanding the role of third-party funding, public entities can better navigate the challenges posed by prolonged litigation and the possibility of increased financial liabilities.

The commercial insurance landscape in 2025 presents a mix of challenges and opportunities. Public entities that proactively adapt to market trends—whether by reassessing coverage, leveraging competition or strengthening risk management—will be better positioned to secure favorable insurance terms and navigate the evolving risk environment effectively.

CYBER

Managing Cyber Crisis Communications

Alliant

As companies prepare for the unfortunate probability of a cyber attack, many continue to overlook the key role played by cyber crisis communications teams. Brendan Hall, Alliant Cyber, is joined by Dan Wire, Head of Crisis Communications at Mandiant Consulting, to discuss the critical need for proactively managing communications during a cyber event, and pitfalls to avoid in order to best protect the enterprise during crisis.

EMPLOYEE BENEFITS

Customizing Benefit Package Value With Voluntary Benefits

Alliant

Robust benefits play a crucial role in attracting and retaining employees. In today’s workforce, which spans multiple generations, each with unique needs and preferences, a one-size-fits-all approach is no longer viable. Employers must offer tailored benefits and services that address this generational diversity, ensuring all employees feel supported and valued.

FEATURED PODCAST

Navigating the Public Sector Workforce Crisis

Alliant

Carleen Patterson welcomes Scott McNea, Alliant Public Entity, to discuss the impact of the workforce crisis on the public sector and five solutions public policy professionals believe will address these challenges. From adjusting job qualification criteria to utilizing AI to streamline the hiring process, there are several strategies organizations can actively implement to minimize the workforce shortage and improve employee retention.

PUBLIC ENTITY EVENTS

Conferences | Speaking Engagements | Webinars

Alliant

Alliant Public Entity attends and produces various events throughout the year. These events provide our team opportunities for professional development and a chance to meet and network with members of the community, learn and present ideas. Join us to network with your peers, learn from industry experts, and meet the Alliant Public Entity team

Insurance Marketplace Insights and Observations: 2024 End-of-Year Report